BTC Price Prediction: Bullish Momentum Amid Institutional Adoption

#BTC

- Technical Strength: MACD and Bollinger Bands signal bullish consolidation.

- Institutional Demand: National reserve strategies and funding rounds highlight growing adoption.

- Market Caution: Declining leverage and whale exits warrant monitoring.

BTC Price Prediction

BTC Technical Analysis: Key Indicators and Trends

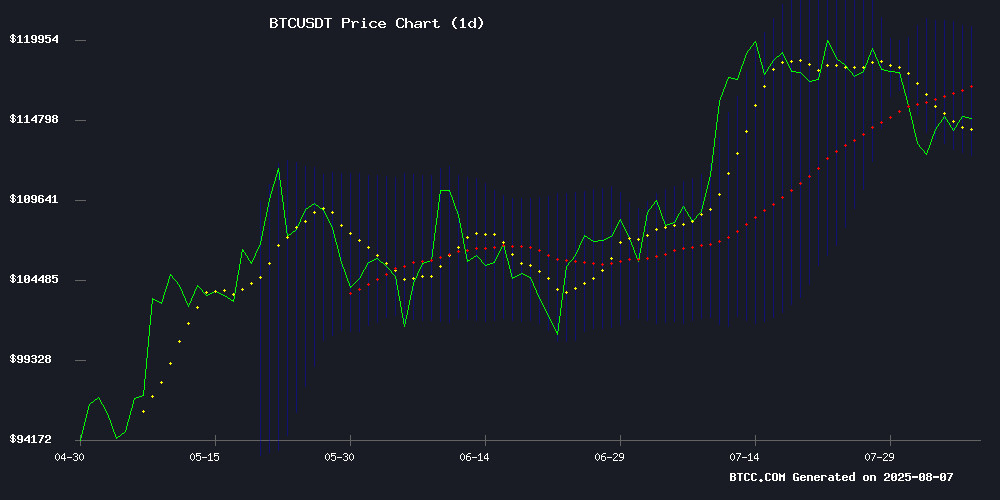

According to BTCC financial analyst James, BTC is currently trading at 114,664.35 USDT, slightly below its 20-day moving average (MA) of 116,649.93. The MACD indicator shows bullish momentum with a value of 2,282.07, significantly above the signal line at 820.95. The Bollinger Bands suggest a consolidation phase, with the price hovering NEAR the middle band (116,649.93). The upper band at 120,803.08 and lower band at 112,496.78 indicate potential resistance and support levels, respectively.

Market Sentiment: Institutional Interest and Macro Trends

BTCC financial analyst James highlights growing institutional interest in BTC, as evidenced by Indonesia and Brazil exploring Bitcoin reserves. News of Bakkt's stake acquisition and Satsuma's $218M funding round with Bitcoin subscriptions further bolster bullish sentiment. However, James notes caution as Binance data shows declining leverage, potentially signaling a market shakeout. The integration of real-time BTC price feeds by Helios Finance and Volo's BTC Vaults on Sui reflect increasing liquidity solutions, supporting long-term growth.

Factors Influencing BTC’s Price

Indonesia Explores Bitcoin Reserve Strategy Amid Economic Diversification Push

Indonesia is evaluating Bitcoin as a potential component of its national reserves, signaling a strategic pivot toward digital assets in response to global economic uncertainty. The initiative, led by the Vice President’s office, aims to hedge against inflation and reduce reliance on traditional fiat currencies like the U.S. dollar.

Bitcoin Indonesia, the country’s largest BTC community, confirmed government interest in leveraging bitcoin mining for long-term economic resilience. "We explored a bold idea: Using Bitcoin mining as a national reserve strategy," the group stated. Adhit, a representative from the VP’s office, emphasized the need for continued public education on Bitcoin’s role in Indonesia’s financial future.

With a GDP of $1.4 trillion and a population exceeding 280 million, Indonesia’s exploration of BTC reserves aligns with broader trends of institutional crypto adoption. No exchanges or additional coins were explicitly mentioned in the context of this initiative.

Indonesia Explores Bitcoin Mining for National Reserves

Indonesia has entered formal discussions about incorporating Bitcoin into its national reserves, marking a potential shift in its economic strategy. The dialogue, led by the Vice President’s office and Bitcoin Indonesia, centers on leveraging Bitcoin as a hedge against inflation and global monetary instability.

The proposal includes direct Bitcoin holdings and mining operations, diverging from Indonesia’s traditional reserve assets like gold and US dollars. This MOVE aligns with a growing trend among nations, including the US and El Salvador, to diversify reserves with cryptocurrency.

Officials are eyeing Bitcoin’s long-term potential, with some referencing Indonesia’s 2045 independence centennial as a strategic milestone. The discussions underscore a broader global momentum toward sovereign Bitcoin adoption, with countries like Pakistan and Kazakhstan also exploring similar initiatives.

Satsuma Secures $218M Funding Round with $125M in Bitcoin Subscriptions

London-based Satsuma Technology has closed a $217.6 million fundraising round, with $125 million of the total subscribed in Bitcoin. The July 28 closing exceeded its minimum target by 63%, demonstrating robust demand from both crypto-native and traditional institutional investors.

CEO Henry Elder framed the raise as a strategic inflection point: "This validates our Core thesis—that combining a Bitcoin-native treasury with decentralized AI redefines corporate value creation." The deal included 1,097.29 BTC accepted as payment, marking the first Bitcoin-denominated subscription for a London-listed entity.

Notable participants included ParaFi Capital, Pantera Capital, and Kraken Ventures alongside established London equity funds. Proceeds will fund operations and Bitcoin accumulation through Satsuma's Singapore subsidiary, bringing its total BTC holdings to 1,126.

Bitcoin Price Attempts Recovery Amid Consolidation

Bitcoin shows tentative signs of recovery as it consolidates above the $114,000 level. The cryptocurrency found support near $112,000 before breaking through a bearish trend line at $114,300, signaling potential short-term upside.

The BTC/USD pair now faces immediate resistance at $115,500, with a decisive break above $116,250 potentially opening the door for further gains. Market participants watch the 100-hour moving average as Bitcoin attempts to reclaim lost ground following its recent swing low.

Indonesia and Brazil Explore Bitcoin Reserves as Strategic Economic Move

Indonesia and Brazil are advancing discussions on incorporating Bitcoin into national reserves, signaling a strategic shift toward digital asset adoption. Indonesian officials engaged with Bitcoin advocates to evaluate using surplus renewable energy for BTC mining, despite maintaining a ban on crypto payments. The proposal highlights Bitcoin's long-term economic potential, citing projections of exponential price growth.

Brazil moves faster, drafting legislation to formalize crypto holdings. Both nations demonstrate how emerging economies view Bitcoin as a reserve asset—not from desperation, but as forward-looking fiscal policy. Indonesia's stable inflation (0.76%) and low debt-to-GDP (39%) underscore this as a calculated diversification play.

Bakkt Acquires 30% Stake in Marusho Hotta, Plans Bitcoin-Centric Rebrand

Bakkt Holdings (BKKT), a major crypto services provider, has strategically acquired a 30% stake in Tokyo-listed MarushoHotta Co., Ltd. (MHT) through a share purchase agreement with RIZAP Group. The deal positions Bakkt as MHT's largest shareholder and marks a pivotal shift toward Bitcoin integration in corporate treasury management.

Phillip Lord, President of Bakkt International, will assume the CEO role at MHT, spearheading plans to incorporate Bitcoin (BTC) and other digital assets into the company's financial strategy. The rebranding to 'Bitcoin JP'—secured via the domain bitcoin.jp—awaits shareholder approval, signaling a bold embrace of crypto-centric operations.

Bakkt's co-CEO Akshay Naheta highlighted Japan's favorable regulatory climate as the foundation for building a Bitcoin-focused business model. The collaboration aims to transform MHT into a flagship Bitcoin treasury company, leveraging Bakkt's institutional expertise and Marusho Hotta's market position.

Binance Data Shows Decline in Leverage: Is a Major Crypto Shakeout Coming?

The global cryptocurrency market has edged lower over the past week, with Bitcoin failing to reclaim recent highs. Total market capitalization now stands at $3.79 trillion, reflecting a 0.4% dip in the last 24 hours.

Binance data reveals a notable reduction in Leveraged trading activity, signaling potential market stabilization. Analysts interpret this as a positive short-term indicator, suggesting the flushing out of overextended positions that often exacerbate volatility.

Bitcoin and altcoins alike face muted buying interest despite periodic price swings. The decline in leverage ratios points to a potential market reset, reducing the likelihood of cascading liquidations that typically trigger sharp downturns.

Volo Launches BTC Vaults to Unlock Bitcoin Liquidity on Sui

Volo, a leading liquid staking protocol on Sui, has introduced the Volo wBTC Vault, a DeFi product aimed at unlocking Bitcoin liquidity within Sui's ecosystem. The vault leverages Wrapped Bitcoin (wBTC) and integrates with NAVI Protocol's deep liquidity to offer high-yield strategies with one-click accessibility.

With over 1,000 BTC already available on Sui, Volo's initiative strengthens the network's position as a Bitcoin DeFi Layer. By tapping into NAVI's lending pools, users gain access to automated yield optimization and leveraged positions, all through a simplified interface.

Volo's launch underscores Sui's growing role as a DeFi hub, enabling Bitcoin to transition from a static asset to a programmable force. The protocol's liquid staking token, vSUI, boasts $50 million in total value locked (TVL), with audits by Ottersec, Movebit, and Hacken ensuring security.

"BTCfi on sui transforms Bitcoin into a dynamic, programmable asset, unlocking unparalleled opportunities," says Ben Liu, Volo lead.

Helios Finance Integrates Allora Network’s Real-Time BTC Predictive Price Feeds

Helios Finance, a centralized Bitcoin trading protocol, has partnered with Allora Network to integrate real-time BTC predictive price feeds. This collaboration leverages Allora's decentralized AI network to enhance trading strategies and capital efficiency.

The integration provides Helios users with unbiased, data-driven intelligence for informed decision-making. Allora's AI infrastructure dynamically adjusts lending strategies, optimizing Bitcoin yield outcomes.

By incorporating prediction market probabilities, Helios offers real-time insights into price movements and market trends. The partnership underscores the growing convergence of AI and decentralized finance in cryptocurrency trading.

Bitcoin Bull Run Under Scrutiny as Whales Exit and Retail Investors Lag

Bitcoin's post-all-time-high landscape faces a critical test as long-term holders begin offloading positions, according to CryptoQuant analyst Maartunn. The market is digesting significant supply pressure, including an 80,000 BTC dump from dormant Satoshi-era wallets moved through Galaxy Digital after 14 years of inactivity.

Retail enthusiasm, typically a late-cycle phenomenon, emerged only after Bitcoin breached $120,000 in mid-July. The cryptocurrency briefly touched $123,000 before retreating to current levels between $113,000-$115,000. While fresh capital supported the initial breakout, the sustainability of this rally now hinges on market absorption of whale distributions.

Brazil Considers $17 Billion Bitcoin Reserve Plan in Historic Move

Brazil's Chamber of Deputies will hold a pivotal hearing on August 20 to debate a bill proposing the allocation of $17 billion in national reserves to Bitcoin. The legislation, introduced by pro-crypto lawmaker Eros Biondini in November 2024, could position Brazil as the world's largest sovereign holder of BTC.

Key financial institutions including the Central Bank and Ministry of Finance will participate alongside fintech firms and crypto advocates. Federal deputy Luiz Philippe de Orleans e Bragança emphasized the need for public discussion, framing the proposal as a strategic diversification of national assets.

The move reflects growing institutional acceptance of Bitcoin as a reserve asset, following similar considerations by other nations. Market analysts anticipate significant Ripple effects across Latin America's crypto economy should the bill progress.

Is BTC a good investment?

Based on current technical and fundamental factors, BTC presents a compelling investment opportunity. Below is a summary of key metrics:

| Metric | Value | Implication |

|---|---|---|

| Price | 114,664.35 USDT | Near support level |

| 20-day MA | 116,649.93 | Potential upside |

| MACD | 2,282.07 (Bullish) | Positive momentum |

| Bollinger Bands | 112,496.78 - 120,803.08 | Consolidation range |

James emphasizes that institutional adoption (e.g., Indonesia/Brazil reserves) and liquidity innovations offset short-term volatility risks.